Help support Cork Safety Alerts by becoming a member – Click Here

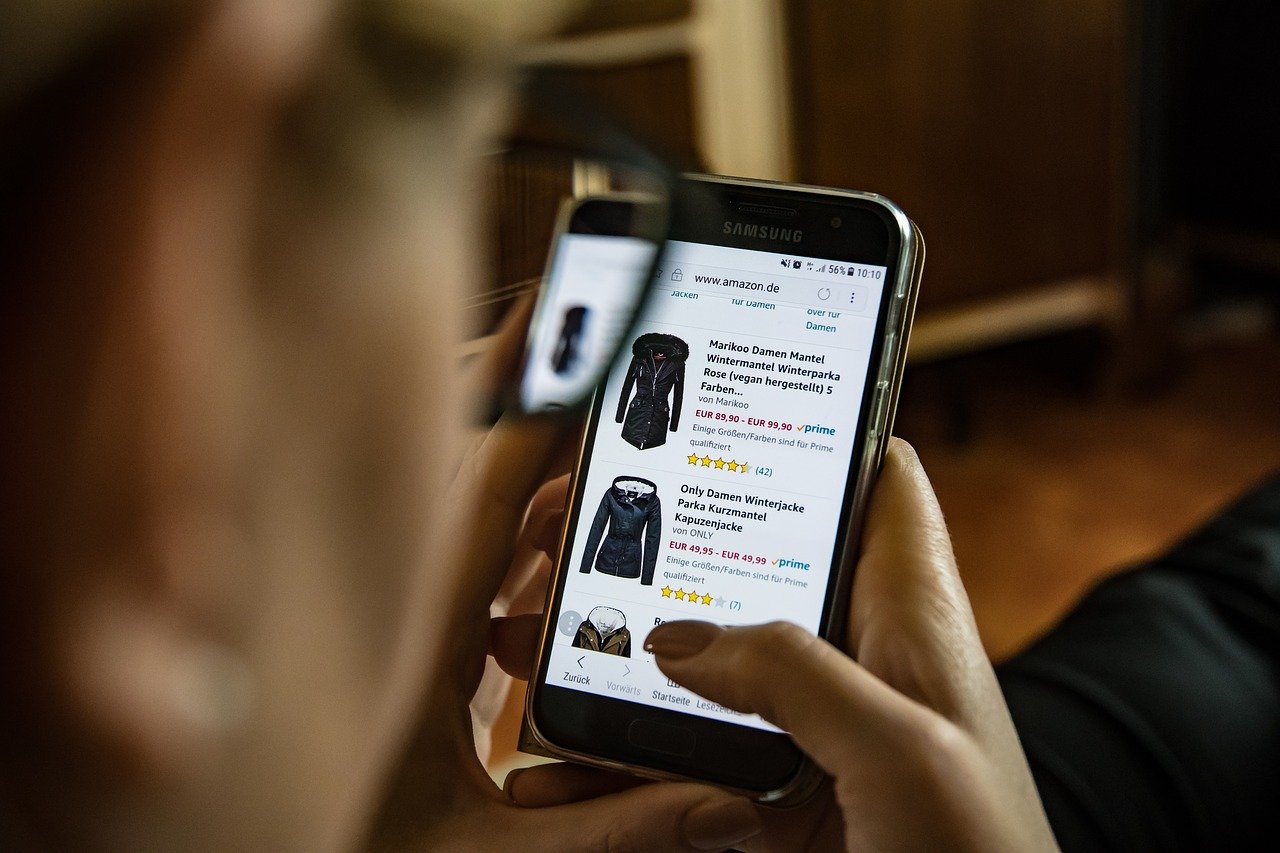

Today in the run up to one of the busiest times of the year for ordering gifts and goods online, Revenue reminded shoppers to be aware that while the price of goods advertised online can seem attractively low, this may be because tax and duty have not been included in the price advertised. However, online shoppers should be aware that additional charges can apply once the purchased goods arrive in Ireland.

Ms Maureen Dalton, Principal Officer in Revenue’s Customs Division, outlined that online shoppers need to be aware of potential additional charges before buying:

“Almost all goods arriving from non-EU countries will be liable to tax and duty. If you shop online, you need to check whether the advertised price includes any tax and duty costs due before you make your decision to buy the goods concerned.

Last year, Revenue officers in postal depots around the country applied charges to almost 100,000 parcels and packets. The average duty and VAT charge per parcel was €68.66. Explaining when these charges might arise Ms Dalton said:

If the cost of the goods you buy, including transport, insurance and handling charges, is more than €22 you will have to pay VAT. If your goods alone cost more than €150 you will have to pay Customs Duty and VAT. For example, if you bought a mobile phone online from China, at an equivalent cost of €212, you would have to pay an additional €54.50 in Customs Duty, VAT, insurance and handling fees. When you buy alcohol and tobacco products online from outside the EU, VAT, Customs Duty and Excise Duty, are payable, regardless of the value of your purchase.

“However, online shoppers also need to be aware that while almost all goods arriving from EU countries are not liable to tax and duty, alcohol and tobacco products arriving from another EU Member State are liable to Excise Duty and VAT. For example, the Excise Duty, VAT and handling fee on an average case of 12 bottles of sparkling wine, originating in another EU country, could add up to €119.27 to your purchase price.”

Ms Dalton concluded her advice to online shoppers by saying:

Make sure you are clear on the actual or real cost of a product before you order it online. This will ensure you not faced with any additional unanticipated charges when you take delivery.

Further information on tax and duty charges that may arise on goods bought online for personal use can be found here.

Want to get €5, absolutely free? Sign up to the ‘Smart’ Debit Card – Curve today, and earn a fiver on us! Find out more here.