- 350,000 receive the Pandemic Unemployment Payment this week

- €103.8 million paid out in PUP payments

- 37,430 receive a higher PUP rate based on their higher average earnings

- Quickest and easiest way to apply for PUP is online at www.MyWelfare.ie

This week, the Department of Social Protection has issued payments valued at €103.8 million, up from €99 million last week, to 350,072 people in receipt of the Pandemic Unemployment Payment (PUP).

The number of people receiving a PUP payment this week represents an increase of just over 7,500 on the 342,505 people paid last week.

The sector with the highest number of people in receipt of the Pandemic Unemployment Payment is Accommodation and Food Service Activities (102,682) followed by Wholesale and Retail Trade (57,015) and Other Sectors e.g. hairdressers and beauty salons (31,048).

This week’s figures are in addition to the 203,172 people who were reported on the Live Register as of the end of October. All Covid-19 Pandemic Unemployment Payments issued will be in recipients’ bank accounts or at their local post office tomorrow, Tuesday, 17th November.

Earlier this month, Social Protection Minister Heather Humphreys secured approval at Cabinet to extend the 2020 earnings reference for employees to September 2020.

This means that people who only commenced employment after February 2020 but have now been laid-off due to increased restrictions can have their payment rate fixed by reference to their earnings in the period January to September 2020.

As a result of this change, some 37,430 people receiving PUP this week will see an increase in their rate of payment. No one will have their weekly rate of payment reduced as a result of this re-assessment of their earnings.

Commenting on this week’s figures, Minister Humphreys said:

While the number of people receiving PUP has increased again this week, it is heartening to see the rate of increase reduce.

The overall number is also much smaller than during the first period of Level 5 restrictions in March and April.

This reflects the fact that a wider range of sectors have been able to continue trading, such as in construction and manufacturing.

However, the number of people in receipt of PUP remains high, demonstrating why it was so important to keep PUP open to new entrants.

As Minister for Social Protection, I will continue to ensure that our welfare supports are available to the people who need them most during this difficult time.

I would also like to remind the self-employed that they can earn up to €480 per month and continue to claim PUP.

The regulations that I announced recently extend the reference period used to assess a person’s prior earnings to end of September .

A person’s prior weekly earnings will now be assessed based on 2019, January to February 2020 and January to September 2020. In order to be as fair as possible to people, the PUP payment rate will be set by reference to the highest of these three amounts.

As a result of these changes and other more up to date customer earnings data received from Revenue, over 37,400 recipients of PUP will receive an increase in their weekly payment commencing this week.

PUP Payment Rates

PUP is paid at four rates. With effect from 2nd October:

- those with prior gross weekly earnings below €200 will continue to receive a rate of €203 per week.

- those with prior gross weekly earnings of €200 to €299.99 will continue to receive €250 per week.

- those with prior gross weekly earnings of €300 to €399.99 will continue to receive €300 per week.

- those with prior gross weekly earnings of €400 or more will receive a rate of €350 per week.

The number of people receiving the maximum rate of €350 this week is 160,115 which represent 46% of the total number receiving PUP with those receiving €300, €250 and €203 representing 18% respectively.

PUP is paid weekly in arrears with applications received up to close of business on Thursday in any week being processed for payment on the following Tuesday. Applications received after Thursday each week, are processed as part of the following week’s claims and paid in the next week after that.

Earnings Assessment: Employees

Reflecting the re-introduction of restrictions in October and under new Regulations recently announced, Social Protection Minister, Heather Humphreys, TD, has changed the reference period used to assess a person’s prior earnings. Until now, a person’s average weekly earnings were assessed by reference to their earnings in 2019 or in the pre-Covid January – February period of 2020 with their payment rate being set based on the higher of these two figures.

Under the change made this week and with effect from 2nd October, earnings are also being assessed by reference to the full period January to September 2020. A person’s prior weekly earnings will now be assessed based on 2019, January to February 2020 and January to September 2020. Their PUP payment rate will be set by reference to the highest of these three amounts.

This means that people who only commenced employment after February 2020 but have now been laid-off due to Covid-19 public health restrictions can have their payment rate determined by reference to their earnings in the period January to September 2020.

In addition, people who may have been in employment before February 2020 but whose earnings have reduced in the period since February (e.g. if working hours reduced) can still have their PUP payment rate set by reference to their earlier, higher earnings.

As a result of this change, some 37,430 people receiving PUP this week will see an increase in their rate of payment. No one will have their weekly rate of payment reduced as a result of this re-assessment of their earnings.

Earnings Assessment: Self-employed

In the case of self-employed people, earnings have been assessed based on the 2019 and 2018 earnings returns to Revenue with the higher figure being used to determine the payment rate.

As self-employment earnings are filed with Revenue on an annual basis the assessment of self-employed earnings will continue as before to be based on the best of a person’s 2018 or 2019 earnings. Any earnings a person may have received as an employee during 2019 will also be considered and added to their self-employment earnings for the purpose of setting the appropriate PUP payment rate.

Self-employed people can also continue to earn up to €480 per month while in receipt of PUP, take up the Part-Time Job Incentive Scheme or avail of standard jobseeker payments.

Any person, including any self-employed person, who believes that their new payment rate does not accurately reflect their prior earnings, can contact the Department to request a review of earnings and forward all supporting documents, which will be matched with Revenue records. They can contact the Department by:

- Emailing [email protected]; or

- Writing to Pandemic Unemployment Rerate Requests, DSP, Intreo Centre, Cork Road, Waterford or

- Calling the Helpline at 1890 800 024 which is open from 9am to 5pm Monday to Friday.

People returning to work

In the past seven days, some 4,492 people closed their PUP, with over 63% (2,868) stating that they were doing so because they are returning to work.

The Department continues to remind workers who are returning to work that they must close their claim for the Pandemic Unemployment Payment (PUP) on the actual date that they start back at work, in order to ensure that their claim is processed correctly.

The easiest way to close a claim for the Pandemic Unemployment Payment is online via www.MyWelfare.ie. Any worker returning to work with an enquiry about closing their claim, can contact the Department’s dedicated income support helpline at 1890 800 024 between 9am and 5pm Monday to Friday.

The largest cohort of people who closed their claims to return to work is in the 25-34 age group (792), followed by those aged 35-44 (663). Full details are available at Appendix 8.

Employment supports available for when people return to work

There are a range of supports for the self-employed who are receiving the Pandemic Unemployment Payment and who are looking to restart their business. In order to reduce the risk of moving from the certainty of the PUP payment to the uncertainty of trading income, self-employed people on PUP, including those who work in the arts/entertainment industry, taxi drivers and others, can now earn up to €480 per month, while retaining their full PUP entitlement.

In addition, the Part-Time Job Incentive scheme is available to self-employed people who come off PUP or a jobseeker’s payment. This scheme, which allows a person to receive a partial jobseeker’s payment, while retaining employment income, may be particularly suited in circumstances where a self-employed person’s income exceeds the €480 per month income threshold on PUP.

Employees, who satisfy the relevant criteria, may claim casual (i.e. part-time) jobseeker’s payments or Short-Time Work Support payments for days of unemployment, even where their employer is claiming the Employment Wage Subsidy Scheme for days of employment. The normal scheme rules and application processes for casual jobseeker payments and Short-Time Work Support apply, including completion of the relevant forms by the employer to certify days of employment and unemployment.

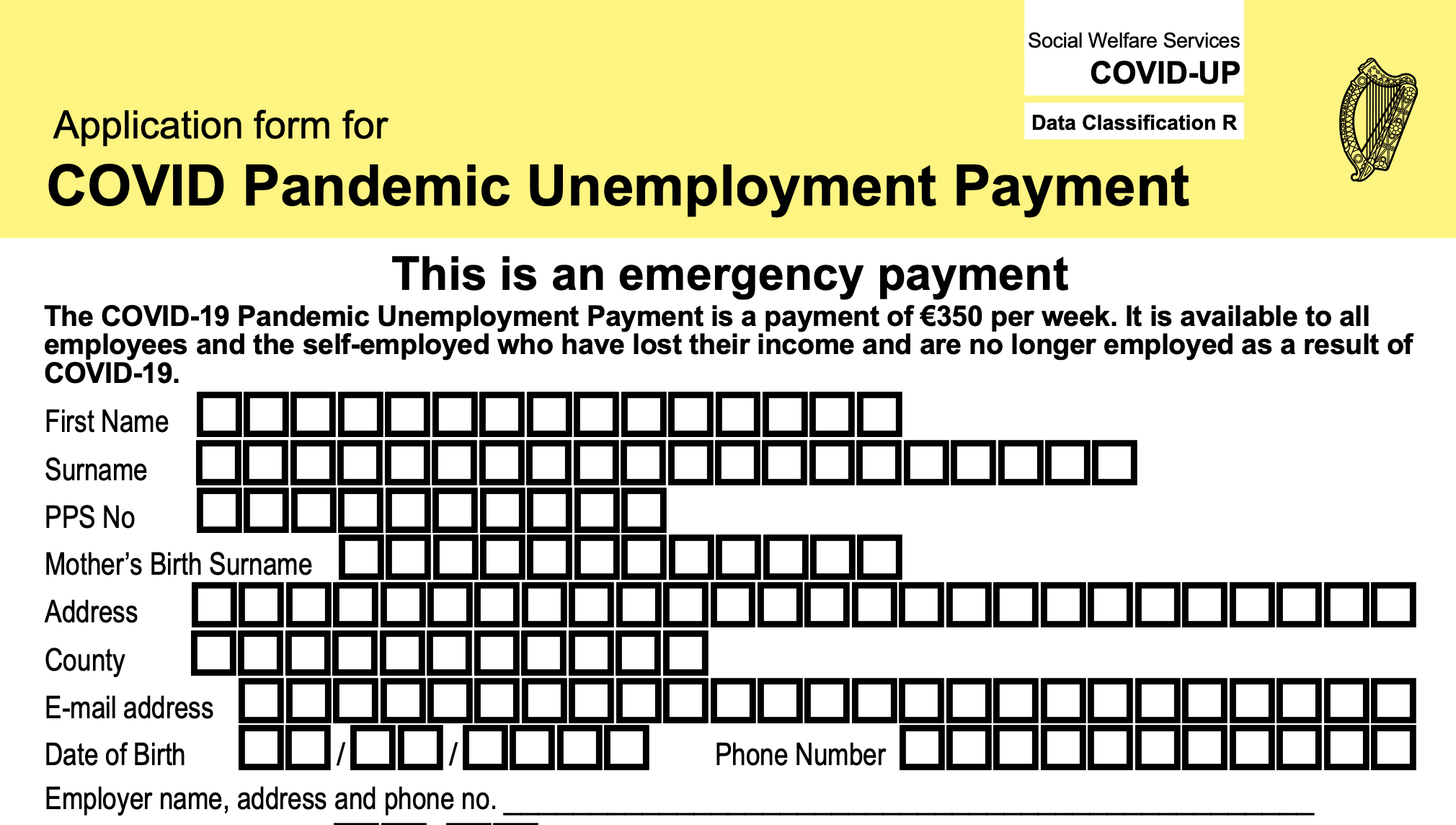

Applying for PUP

To apply for the Pandemic Unemployment Payment, the easiest and quickest way is to do so online at www.MyWelfare.ie. When applying, people should provide the name of their employer and details of their last day of employment.

In the interests of the public health advice and observing social distancing people are asked, if possible, not to attend their local Intreo Centre. Instead, they should avail of the online services available through www.MyWelfare.ie.

Covid-19 Enhanced Illness Benefit Payment

Since March, a cumulative total of 87,146 people under the age of 66 have been medically certified for receipt of the Covid-19 Enhanced Illness Benefit.

Today, some 2,500 people are currently in receipt of an Enhanced Illness Benefit payment.

The number of people medically certified to receive the Enhanced Illness Benefit has increased in every county again this week, the greatest number being in Dublin (24,072), followed by Cork (9,466), Galway (5,345), Kildare (4,249) and Meath (3,514).

There has also been an increase in every sector affected by the Covid-19 virus again this week. The sectors with the greatest number of people medically certified for receipt of a Covid-19 Illness Benefit payment are Wholesale and Retail Trade (18,689) and Human Health and Social Work (16,104), followed by Manufacturing (12,018). Full details are at Appendices 9, 10 and 11.

Appendices

Appendix 1 – Analysis of Pandemic Unemployment Payments by County

Appendix 2 – Pandemic Unemployment Payments by Sector

Appendix 3 – Pandemic Unemployment Payments by Age Profile

Appendix 4 – Pandemic Unemployment Payment Rates by gender

Appendix 5 – Pandemic Unemployment Payment Rates by age

Appendix 6 – Analysis of People who Closed their PUP Claim to Return to Work

Appendix 7 – Analysis of Closed Pandemic Unemployment Payments by Sector

Appendix 8 – Analysis of Closed Pandemic Unemployment Payments Age Profile

Appendix 9 – Enhanced Illness Benefit Payments by County

Appendix 10 – Enhanced Illness Benefit Payments by Sector

Appendix 11 – Enhanced Illness Benefit Payments Age Profile

Appendix 1 – Analysis of Pandemic Unemployment Payments

There are 350,072 people in receipt a Pandemic Unemployment Payment of which 176,636 are female and 173,436 are male.

County Breakdown

| County | Number of people in receipt of a Pandemic Unemployment Payment on 17th November | Number of people in receipt of a Pandemic Unemployment Payment on 10th November | Number of people in receipt of a Pandemic Unemployment Payment on 5th May |

| Carlow | 3,676 | 3,606 | 7,800 |

| Cavan | 4,719 | 4,659 | 9,700 |

| Clare | 7,494 | 7,362 | 14,600 |

| Cork | 35,193 | 34,529 | 61,900 |

| Donegal | 12,360 | 12,060 | 22,700 |

| Dublin | 113,902 | 111,588 | 174,200 |

| Galway | 19,498 | 19,158 | 32,300 |

| Kerry | 13,864 | 13,547 | 22,200 |

| Kildare | 15,381 | 15,033 | 26,100 |

| Kilkenny | 5,546 | 5,449 | 10,600 |

| Laois | 4,637 | 4,497 | 8,600 |

| Leitrim | 2,027 | 1,968 | 4,100 |

| Limerick | 13,782 | 13,475 | 22,300 |

| Longford | 2,325 | 2,228 | 4,500 |

| Louth | 10,745 | 10,443 | 17,300 |

| Mayo | 9,356 | 9,071 | 16,400 |

| Meath | 13,111 | 12,862 | 25,000 |

| Monaghan | 4,164 | 4,036 | 8,200 |

| Offaly | 4,357 | 4,263 | 8,900 |

| Roscommon | 3,462 | 3,363 | 7,100 |

| Sligo | 4,355 | 4,263 | 7,700 |

| Tipperary | 9,379 | 9,171 | 18,800 |

| Waterford | 8,214 | 8,009 | 14,100 |

| Westmeath | 6,543 | 6,368 | 11,700 |

| Wexford | 10,679 | 10,384 | 20,500 |

| Wicklow | 10,663 | 10,467 | 18,700 |

| County not included | 640 | 646 | 2,000 |

| Total | 350,072 | 342,505 | 598,000 |

Appendix 2 – Pandemic Unemployment Payments – Sector Breakdown

The sector with the highest number of people in receipt of the Pandemic Unemployment Payment is Accommodation and Food Service Activities (102,682) followed by Wholesale and Retail Trade (57,015) and Other Sectors e.g. hairdressers and beauty salons (31,048).

| Sector Breakdown

Industrial Sector | Number of people in receipt of Pandemic Unemployment Payment on 17th November | Number of people in receipt of Pandemic Unemployment Payment on 10th November | Number of people in receipt of Pandemic Unemployment Payment on 5th May |

| Agriculture, Forestry and Fishing; Mining and Quarrying | 4,321 | 4,105 | 8,600 |

| Manufacturing | 15,465 | 15,263 | 37,400 |

| Electricity, gas supply; Water supply, sewerage and waste management | 1,134 | 1,108 | 2,100 |

| Construction | 21,061 | 20,439 | 79,300 |

| Wholesale and Retail Trade; Repair of Motor Vehicles and motorcycles | 57,015 | 55,516 | 90,300 |

| Transportation and storage | 9,127 | 8,959 | 17,900 |

| Accommodation and food service activities | 102,682 | 100,994 | 128,500 |

| Information and communication activities | 7,526 | 7,449 | 11,800 |

| Financial and insurance activities | 7,119 | 7,030 | 12,500 |

| Real Estate activities | 5,442 | 5,348 | 8,100 |

| Professional, Scientific and Technical activities | 13,294 | 13,095 | 24,800 |

| Administrative and support service activities | 29,674 | 28,664 | 45,800 |

| Public Administration And Defence; Compulsory Social Security | 5,354 | 5,307 | 14,400 |

| Education | 10,340 | 10,353 | 22,000 |

| Human Health And Social Work activities | 10,271 | 10,144 | 22,500 |

| Arts, entertainment and recreation | 11,973 | 11,781 | 14,200 |

| Other Sectors (e.g. hairdressers and beauty salons) | 31,048 | 30,141 | 39,200 |

| Unclassified or unknown | 7,226 | 6,809 | 18,600 |

| Total | 350,072 | 342,505 | 598,000 |

Appendix 3 – Pandemic Unemployment Payment – Age Profile

| Age category | Number of people in receipt of Pandemic Unemployment Payment on17th November | Number of people in receipt of Pandemic Unemployment Payment on10th November |

| < 25 | 89,406 | 86,944 |

| 25-34 | 80,079 | 78,337 |

| 35-44 | 75,788 | 74,227 |

| 45-54 | 59,827 | 58,820 |

| 55+ | 44,972 | 44,177 |

| Total | 350,072 | 342,505 |

Appendix 4 – Pandemic Unemployment Payment Rates breakdown by gender

| Gender | Number of people in receipt of €350 on 17thNovember | Number of people in receipt of €300 on 17th November | Number of people in receipt of €250 on 17th November | Number of people in receipt of €203 on 17thNovember |

| Male | 93,670 | 28,432 | 25,666 | 25,668 |

| Female | 66,445 | 35,399 | 37,884 | 36,908 |

| Total | 160,115 | 63,831 | 63,550 | 62,576 |

Appendix 5 – Pandemic Unemployment Payment Rates breakdown by age

| Age category

| Number of people in receipt of €350 on 17thNovember | Number of people in receipt of €300 on 17thNovember | Number of people in receipt of €250 on 17thNovember | Number of people in receipt of €203 on 17thNovember |

| < 25 | 22,175 | 21,134 | 25,227 | 20,870 |

| 25-34 | 44,243 | 15,336 | 11,202 | 9,298 |

| 35-44 | 41,950 | 11,640 | 10,633 | 11,565 |

| 45-54 | 31,127 | 9,000 | 9,006 | 10,694 |

| 55+ | 20,620 | 6,721 | 7,482 | 10,149 |

| Total | 160,115 | 63,831 | 63,550 | 62,576 |

Appendix 6 – Analysis of Closed PUP payments to return to Work

Around 2,868 people who have closed their account for return to work since 8th November will receive a Pandemic Unemployment Payment tomorrow, 17thNovember. Of these 1,630 are male and 1,238 are female.

County Breakdown

| County | Number of people who closed their PUP payment from 17thNovember to return to work | Number of people who closed their PUP payment from 10th Novemberto return to work | Number of people who closed their PUP payment from 3rd Novemberto return to work |

| Carlow | 40 | 25 | 31 |

| Cavan | 67 | 57 | 49 |

| Clare | 67 | 51 | 52 |

| Cork | 316 | 288 | 273 |

| Donegal | 98 | 75 | 73 |

| Dublin | 837 | 675 | 761 |

| Galway | 165 | 154 | 141 |

| Kerry | 80 | 79 | 74 |

| Kildare | 153 | 108 | 128 |

| Kilkenny | 46 | 27 | 24 |

| Laois | 30 | 26 | 42 |

| Leitrim | 17 | 12 | 11 |

| Limerick | 106 | 81 | 81 |

| Longford | 17 | 15 | 22 |

| Louth | 79 | 76 | 68 |

| Mayo | 61 | 47 | 55 |

| Meath | 119 | 80 | 111 |

| Monaghan | 38 | 32 | 37 |

| Offaly | 53 | 40 | 37 |

| Roscommon | 26 | 16 | 32 |

| Sligo | 34 | 22 | 25 |

| Tipperary | 88 | 71 | 76 |

| Waterford | 66 | 51 | 55 |

| Westmeath | 69 | 44 | 45 |

| Wexford | 98 | 68 | 81 |

| Wicklow | 90 | 92 | 64 |

| County not included | 8 | 7 | 12 |

| Total | 2,868 | 2,319 | 2,460 |

Appendix 7 – Closed Pandemic Unemployment Payments – Sector Breakdown

The top three sectors from which employees closed their Pandemic Unemployment Payment in the week ending 17th November to return to work areWholesale and Retail Trade; Repair of Motor Vehicles and motorcycles (532), Accommodation and Food Service Activities (482) and Construction (322).

|

Industrial Sector | Number of people who closed their PUP payment from 17th Novemberto return to work | Number of people who closed their PUP payment from 10th Novemberto return to work |

| Agriculture, Forestry and Fishing; Mining and Quarrying | 36 | 26 |

| Manufacturing | 296 | 242 |

| Electricity, gas supply; Water supply, sewerage and waste management | 7 | 10 |

| Construction | 322 | 239 |

| Wholesale and Retail Trade; Repair of Motor Vehicles and motorcycles | 532 | 359 |

| Transportation and storage | 96 | 101 |

| Accommodation and food service activities | 482 | 405 |

| Information and communication activities | 62 | 69 |

| Financial and insurance activities | 59 | 47 |

| Real Estate activities | 25 | 28 |

| Professional, Scientific and Technical activities | 140 | 123 |

| Administrative and support service activities | 242 | 206 |

| Public Administration And Defence; Compulsory Social Security | 69 | 68 |

| Education | 121 | 121 |

| Human Health And Social Work activities | 187 | 140 |

| Arts, entertainment and recreation | 65 | 57 |

| Other Sectors (e.g. hairdressers and beauty salons) | 102 | 63 |

| Unclassified or unknown | 25 | 15 |

| Total | 2,868 | 2,319 |

Appendix 8 – Closed Pandemic Unemployment Payments to return to work – Age Profile

| Age category | Number of people who closed their PUP payment from 17thNovember to return to work | Number of people who closed their PUP payment from 10th November to return to work |

| < 25 | 629 | 458 |

| 25-34 | 792 | 620 |

| 35-44 | 663 | 534 |

| 45-54 | 488 | 419 |

| 55+ | 296 | 288 |

| Total | 2,868 | 2,319 |

Appendix 9 – Analysis of Covid-19 Enhanced Illness Benefit

To date, 87,146 people have been medically certified for receipt of a Covid-19 related Illness Benefit payment, of whom 47,848 are female and 39,298 are male.

Some 2,500 people are currently in receipt of an Enhanced Illness Benefit payment.

County Breakdown (based on the county recorded on the Illness Benefit certificate)

| County | Number of people who have been medically certified for receipt of Enhanced Illness Benefit to 17th November | Number of people who have been medically certified for receipt of Enhanced Illness Benefit to 10th November | Number of people who have been medically certified for receipt of Enhanced Illness Benefit to 3rd November |

| Carlow | 1,211 | 1,182 | 1,144 |

| Cavan | 2,272 | 2,228 | 2,139 |

| Clare | 1,588 | 1,544 | 1,479 |

| Cork | 9,466 | 9,220 | 8,885 |

| Donegal | 2,541 | 2,437 | 2,315 |

| Dublin | 24,072 | 23,495 | 22,906 |

| Galway | 5,345 | 5,197 | 4,987 |

| Kerry | 2,070 | 2,002 | 1,929 |

| Kildare | 4,249 | 4,173 | 4,052 |

| Kilkenny | 1,772 | 1,713 | 1,669 |

| Laois | 1,467 | 1,416 | 1,375 |

| Leitrim | 389 | 379 | 365 |

| Limerick | 2,960 | 2,883 | 2,786 |

| Longford | 734 | 697 | 674 |

| Louth | 2,523 | 2,465 | 2,360 |

| Mayo | 2,017 | 1,928 | 1,860 |

| Meath | 3,514 | 3,386 | 3,252 |

| Monaghan | 1,609 | 1,573 | 1,525 |

| Offaly | 1,377 | 1,349 | 1,311 |

| Roscommon | 1,243 | 1,217 | 1,190 |

| Sligo | 828 | 795 | 760 |

| Tipperary | 3,139 | 3,072 | 2,953 |

| Waterford | 3,079 | 2,982 | 2,865 |

| Westmeath | 1,584 | 1,540 | 1,489 |

| Wexford | 2,997 | 2,907 | 2,812 |

| Wicklow | 2,572 | 2,527 | 2,467 |

| Other (NI & Foreign Address) | 528 | 496 | 450 |

| Total | 87,146 | 84,803 | 81,999 |

Appendix 10 – Covid-19 Enhanced Illness Benefit – Sector Breakdown

The sectors with the highest number of people who have been medically certified for receipt of a Covid-19 Illness Benefit payment to date are Wholesale and Retail Trade (18,689), Human Health and Social Work (16,104) and Manufacturing (12,018).

| Sector Breakdown

Industrial Sector | Number of people who have been medically certified for receipt of Enhanced Illness Benefit to 17th November | Number of people who have been medically certified for receipt of Enhanced Illness Benefit to 10th November | Number of people who have been medically certified for receipt of Enhanced Illness Benefit to 3rd November |

| Agriculture, Forestry and Fishing; Mining and Quarrying | 852 | 819 | 787 |

| Manufacturing | 12,018 | 11,707 | 11,301 |

| Electricity, gas, steam supply; Water supply; Sewerage, waste management | 433 | 424 | 405 |

| Construction | 3,921 | 3,785 | 3,616 |

| Wholesale and Retail Trade; Repair of Motor Vehicles and motorcycles | 18,689 | 18,178 | 17,551 |

| Transportation and storage | 3,177 | 3,093 | 2,983 |

| Accommodation and food service activities | 5,369 | 5,177 | 4,942 |

| Information and communication activities | 1,427 | 1,384 | 1,348 |

| Financial and insurance activities | 3,144 | 3,085 | 3,011 |

| Real Estate activities | 717 | 679 | 661 |

| Professional, Scientific and Technical activities | 2,720 | 2,651 | 2,572 |

| Administrative and support service activities | 7,692 | 7,528 | 7,329 |

| Public Administration And Defence; Compulsory Social Security | 3,514 | 3,412 | 3,296 |

| Education | 2,313 | 2,221 | 2,117 |

| Human Health And Social Work activities | 16,104 | 15,772 | 15,397 |

| Arts, entertainment and recreation | 848 | 825 | 780 |

| Other Sectors | 2,997 | 2,921 | 2,834 |

| Unclassified or unknown | 1,211 | 1,142 | 1,069 |

| Total | 87,146 | 84,803 | 81,999 |

Appendix 11 – Enhanced Illness Benefit – Age Profile

| Age category

| Number of people who have been medically certified for receipt of Enhanced Illness Benefit to 17th November | Number of people who have been medically certified for receipt of Enhanced Illness Benefit to 10th November | Number of people who have been medically certified for receipt of Enhanced Illness Benefit to 3rd November |

| < 25 | 13,195 | 12,648 | 12,060 |

| 25-34 | 21,563 | 20,976 | 20,282 |

| 35-44 | 23,971 | 23,392 | 22,717 |

| 45-54 | 17,308 | 16,893 | 16,366 |

| 55+ | 11,109 | 10,894 | 10,574 |

| Total | 87,146 | 84,803 | 81,999 |

Want to get €5, absolutely free? Sign up to the ‘Smart’ Debit Card – Curve today, and earn a fiver on us! Find out more here.